Skip to content

Home

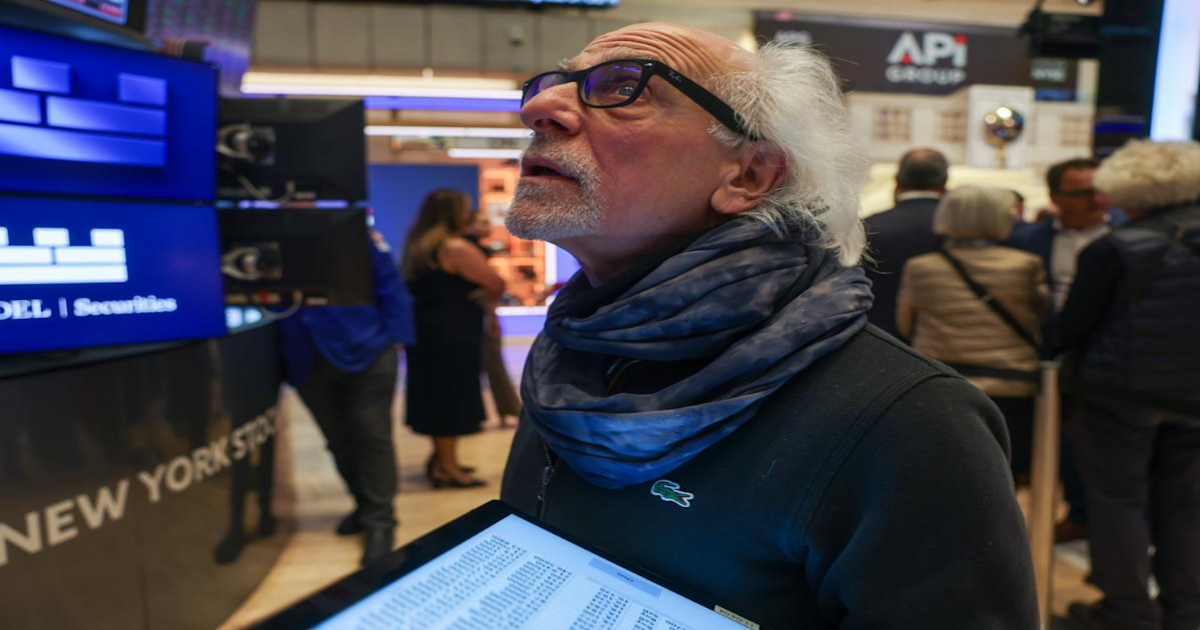

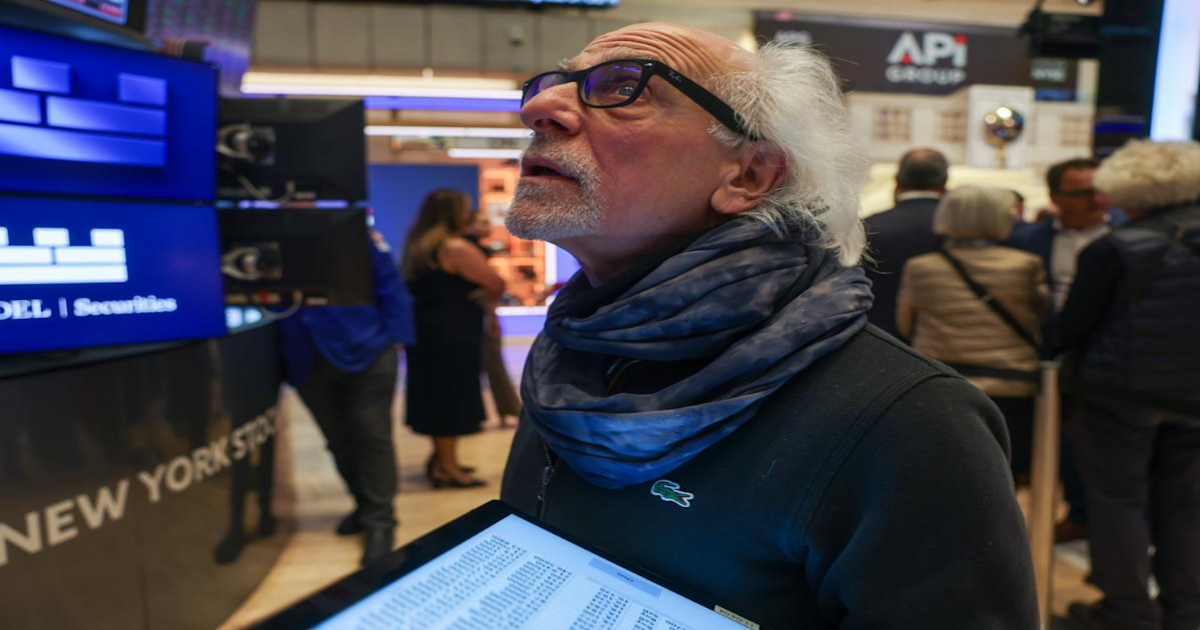

Stock market today: Nvidia earnings boost Nasdaq, S&P 500, Dow retreat on tariff uncertainty

- President Trump’s trade plans ran into a stumbling block this week when a court blocked a wide swath of his tariffs.

- But he could bounce back quickly even if White House plans to appeal the defeat don’t pan out.

- That’s because Congress has been handing its tariff powers over to the executive branch for decades, with an array of other authorities at the ready — especially from two laws passed in 1962 and 1974 — if Trump needs to reimplement things like his “Liberation Day” tariffs by different means.

- “It’s a setback [but] it doesn’t mean that the president can’t find other means or authorities to try to implement this policies, and it’s also just the first step in litigation,” Greta Peisch, a former Biden administration trade general counsel, now at law firm Wiley Rein, noted in a Yahoo Finance appearance Thursday morning.

- Read more here.

- Federal Reserve chair Jerome Powell met with President Donald Trump at the White House today, according to a release from the central bank.

- “At the President’s invitation, Chair Powell met with the President today at the White House to discuss economic developments including for growth, employment, and inflation,” the release said. “Chair Powell did not discuss his expectations for monetary policy, except to stress that the path of policy will depend entirely on incoming economic information and what that means for the outlook.”

- Trump, who had been badgering Powell to cut interest rates over the past several months via his social media platform Truth Social, has yet to post about the meeting.

- A US trade court decision that put at least a temporary pause on many of President Trump’s wide-ranging tariffs isn’t cooling Wall Street’s fears over policy uncertainty.

- “It is not clear that this is a catalyst for a sustained new risk-on [trade],” Barclays global chairman of research Ajay Rajadhyaksha wrote in a note to clients while pointing out that lower tariffs would mean less revenue back to the US government. That could cause Trump’s new tax bill to push the US deficit higher if it went into effect, exacerbating the recent rise in bond yields and potentially weighing on the equity market.

- Stock futures soared overnight on the news, but the equity market rally cooled off quickly with the S&P 500 up just 0.2% in early afternoon trading. The administration has already appealed the decision and strategists like Rajadhyaksha have pointed out that this could merely delay Trump’s tariff rollout, not eliminate it.

- “Investors were hoping that tariff negotiations would largely be ironed out in the next couple of months, leaving the Administration free to focus far more on growth-positive policy including deregulation,” Rajadhyaksha wrote. “At least optically, that entire process is now pushed back a few months.”

- Read more here.

- Crude oil prices retreated on Thursday amid a looming decision due this weekend over the possibility of increased production from OPEC+ in July.

- West Texas Intermediate (CL=F) futures fell 1% to hover above $61 per barrel. Brent crude (BZ=F), the international benchmark, also traded above $63 per barrel.

- The Organization of the Petroleum Exporting Countries and its allies (OPEC+) will decide this weekend whether to raise output in July following increases already set for May and June.

- Wall Street anticipates the group will vote in favor of increasing supply by 411,000 barrels per day.

- Yahoo Finance’s Claire Boston reports:

- Read more here.

- Nvidia (NVDA)

- The AI chip giant was the No. 1 trending ticker on Yahoo Finance on Thursday after beating expectations on revenue, but falling short on adjusted earnings per share (EPS) due to the impact of the ban on shipments of its H20 units to China.

- The company also said it expects to miss out on roughly $8 billion in sales of H20s in the second quarter.

- Read the latest on Nvidia’s earnings here.

- e.l.f. Beauty (ELF)

- Shares of the cosmetics company rose more than 20% on Thursday on the heels its quarterly results and $1 billion acquisition announcement of Rhode, a brand founded by Hailey Bieber.

- Best Buy (BBY)

- Best Buy shares tanked more than 7% on Thursday after the retailer reported mixed earnings and cut guidance due to the Trump administration’s tariffs.

- Same-store sales fell 0.7% year over year while revenue fell 0.9% to $8.77 billion, missing Wall Street estimates. Adjusted earnings per share slid 4% to $1.15, beating estimates of $1.09.

- Read more about Best Buy earnings here.

- US stocks rose on Thursday in the wake of AI chip giant Nvidia’s (NVDA) earnings report and a court ruling that threatened President Trump’s tariff policy.

- The S&P 500 (^GSPC) gained about 0.8%. The Dow Jones Industrial Average (^DJI) moved up roughly 0.3%, while the Nasdaq Composite (^IXIC) climbed 1.4%.

- Tech stocks led the gains, with Nvidia jumping more than 5% following its quarterly report. Its earnings topped estimates, but the company warned of a second quarter revenue impact due to US restrictions on exports to China.

- Other “Magnificent Seven” stocks also rose, including Amazon (AMZN). Shares in Tesla (TSLA) put on 2% after CEO Elon Musk teased a June rollout of the EV maker’s robotaxis and confirmed he was leaving his role in the Trump administration.

- On Wednesday evening, a panel of judges at the US Court of International Trade blocked Trump’s global tariffs on the grounds that the president lacked the authority to issue them using emergency powers. The decision will likely be appealed by the Trump administration in federal court.

- Weekly filings for unemployment benefits moved higher last week while the number of Americans filing for unemployment insurance on an ongoing basis once again hit their highest level since November 2021 as the US labor market continues to show signs of slowing.

- Data from the Department of Labor released Thursday morning showed 240,000 initial jobless claims were filed in the week ending May 24, up from 226,000 the week prior and above economists’ expectations for 230,000.

- Meanwhile, 1.919 million continuing claims were filed, up from 1.893 million the week prior and the highest level seen since November 2021. Economists see an increase in continuing claims as a sign that those out of work are taking longer to find new jobs.

- Tesla (TSLA) stock rose 2% in premarket trading after CEO Elon Musk teased the rollout of its robotaxis and confirmed he was leaving his role in government.

- Musk said the EV maker has been testing driverless Model Y cars in Austin, Texas, for the past several days. Previously, he said Tesla would begin testing by the end of June, per Reuters. The rollout is also expected to feature 10 to 20 cars to start, based on past comments.

- “A month ahead of schedule,” Musk wrote on X.

- Also lifting shares was a confirmation from a White House official that Musk will no longer serve on the Department of Government Efficiency (DOGE). Musk’s involvement in government was controversial for Tesla shareholders, many of whom felt his attention had become too divided.

- “Back to spending 24/7 at work and sleeping in conference/server/factory rooms,” Musk said on Tuesday, adding that he “must be super focused on 𝕏/xAI and Tesla (plus Starship launch next week), as we have critical technologies rolling out.”

- Read more here about Tesla’s driverless cars and Musk’s return to the office.

- As a US trade court ruling upends President Trump’s trade strategy, Yahoo Finance’s Josh Schafer points out the rewards that awaited investors who snapped up tariff-bruised stocks.

- Read more here.

- Economic data: First quarter GDP; First quarter personal consumption; Initial jobless claims, (week ended May 24); Pending home sales (April)

- Earnings: American Eagle (AEO), Best Buy (BBY), Burlington Stores (BURL), Build-a-Bear Workshop (BBW), Costco (COST), Dell (DELL), Foot Locker (FL), Hormel Foods (HRL), Gap (GAP), Marvell Technology (MRVL), Ulta (ULTA), Zscaler (ZS)

- The United States Court of International Trade has ruled Trump tariffs “unlawful.” Meanwhile, Nvidia earnings lifted Wall Street, even as the chipmaker flagged risks relating to AI chip controls.

- Here are some of the biggest stories you may have missed overnight and early this morning:

- Trump’s tariffs in limbo after trade court’s stunning rebuke

- Nvidia pops, CEO warns US chip curbs boost China rivals

- Court rules Trump doesn’t have authority to impose tariffs

- Buying the dip hasn’t paid off this much in 30 years

- Nvidia gets a pass after earnings miss: What Wall Street is saying

- Real winner in GameStop’s bitcoin pivot is Strategy

- Goldman: Trump can offset tariff ruling with other tools

- Microsoft shares go from laggard to leader as AI growth improves

- Shares in HP Inc. (HPQ) fell by 8% on Thursday in premarket trading after the company’s profit outlook missed estimates and it cut the annual earnings forecast, citing a weaker economy and continuing costs from US tariffs on goods from China.

- Bloomberg News reports:

- Read more here.

- Markets may be celebrating the latest turn in the tariffs saga, but the US trade court’s block isn’t definitive — and that means there’s still cause for concern, some analysts say.

- Reuters reports:

- Read more here.

- A landmark decision by the US Court of International Trade has deemed many of President Trump’s tariffs ‘unlawful’ and sent markets into a global upturn.

- Reuters reports:

- Read more here.