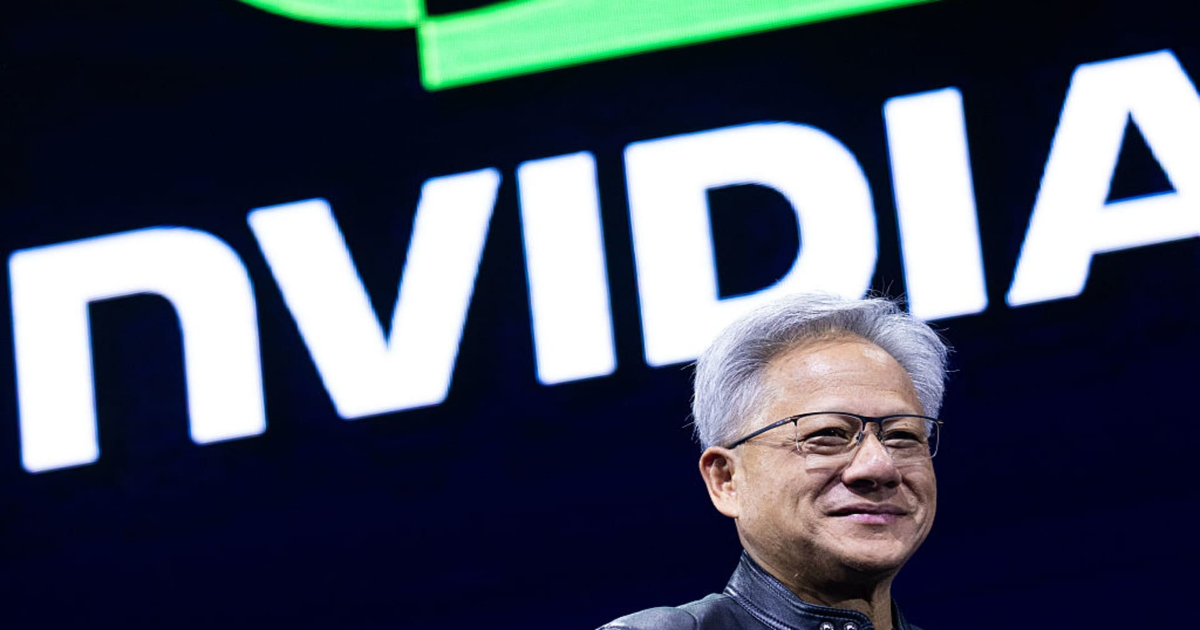

Nvidia has shaken off concerns about tariffs and competition to hit a new Wall Street milestone, reinforcing that the artificial intelligence boom is still at the heart of this stock market rally. The chip giant briefly passed $4 trillion in market value on Wednesday, the first company ever to do so, and its shares are now up 21% year to date. Last year, Nvidia soared 171% and in 2023 it rose 239%. NVDA 1Y mountain Nvidia has rebounded back to being the world’s biggest company by market cap. Nvidia initially became the most valuable company in the world more than a year ago, with a then-market cap of around $3.3 trillion. The stock’s torrid rally cooled somewhat after that, and worries about DeepSeek and trade policy changes for semiconductors hit Nvidia earlier this year, but now the upward move seems back on track. Being the world’s most valuable company is not a sign of permanent superiority. General Electric and ExxonMobil each held the crown at one point but have since receded in importance in terms of the entire stock market. Microsoft briefly took the top spot before the tech bubble, and then had to claw its way back up the ranks. But, in Wall Street’s eyes, Nvidia seems to have room to extend its tenure as a top stock. The company has a buy or strong buy rating from 58 of the 65 major analysts that cover it, according to LSEG. “Look out at the next four quarters of earnings growth. This year, earnings are expected to grow almost 50%. The stock only trades at 33 times expected earnings over the next four quarters … that’s a reasonable price, I think, for what has turned into a company leading an AI charge,” said Bret Kenwell, U.S. investment analyst at eToro. Beyond its own growth, Nvidia is also the emblem of the broader AI rally. The performance of other major stocks shows how strong the theme still is. Microsoft , with its deep ties to OpenAI, is up 19% year to date. Meta Platforms , which is aggressively recruiting in AI, has gained 25%. While Apple , which has struggled to hit on an AI strategy, is down more than 15% on the year. Outside of Big Tech, it seems like the enthusiasm for this sector is starting to lift up some smaller stocks as well, Kenwell said. “It’s nice to at least see the rally broadening out to even the laggards of that [semiconductor] group. And now I think we’re even starting to see it in other places, in other industries. We’re seeing cybersecurity names kind of getting a little bit of a jolt. We’re seeing big data companies … doing really well. And I think those are all kind of being helped along by the same AI thematic,” Kenwell said.