Nvidia (NVDA) on Wednesday became the first publicly traded company to hit the $4 trillion mark, surpassing fellow tech players including Microsoft (MSFT) and Apple (AAPL). The chipmaker’s stock price is up around 22% year to date and 24% over the past 12 months.

Nvidia closed Wednesday’s session at a record high, up nearly 2% for the day. Its market cap ended up slightly under the $4 trillion mark at the close.

The move comes as the chip giant continues to ride the wave of generative AI hype that kicked off with the introduction of OpenAI’s ChatGPT in 2022.

Nvidia’s chips, modified graphics cards, and CUDA software platform are designed to both train and run AI programs, giving it a strategic advantage that rivals AMD (AMD) and Intel (INTC) continue to struggle to overcome.

Tech behemoths, including Amazon (AMZN), Google (GOOG), Meta (META), Microsoft, Tesla (TSLA), and others, are spending hundreds of billions of dollars on the company’s hardware as they build out the data centers necessary to provide cloud-based AI offerings to their customers and create their own internal AI models.

Nvidia’s stock price has been on a roller coaster this year. The company took a $600 million hit to its market cap in January after DeepSeek revealed its R-1 model, which the company claimed it was able to train using less than top-of-the-line chips.

Wall Street went into meltdown mode as fears arose that Nvidia’s pricey data center chips were falling out of fashion. Couple that with concerns that the AI industry was moving from training AI models to inferencing, or using, AI models, and the market started to believe Nvidia’s processors were no longer necessary.

But so far, both of those have proven wrong. Nvidia’s chips are still among the best for training AI models, and the industry has shown that inferencing benefits from more powerful AI processors, as they allow them to answer more complex questions.

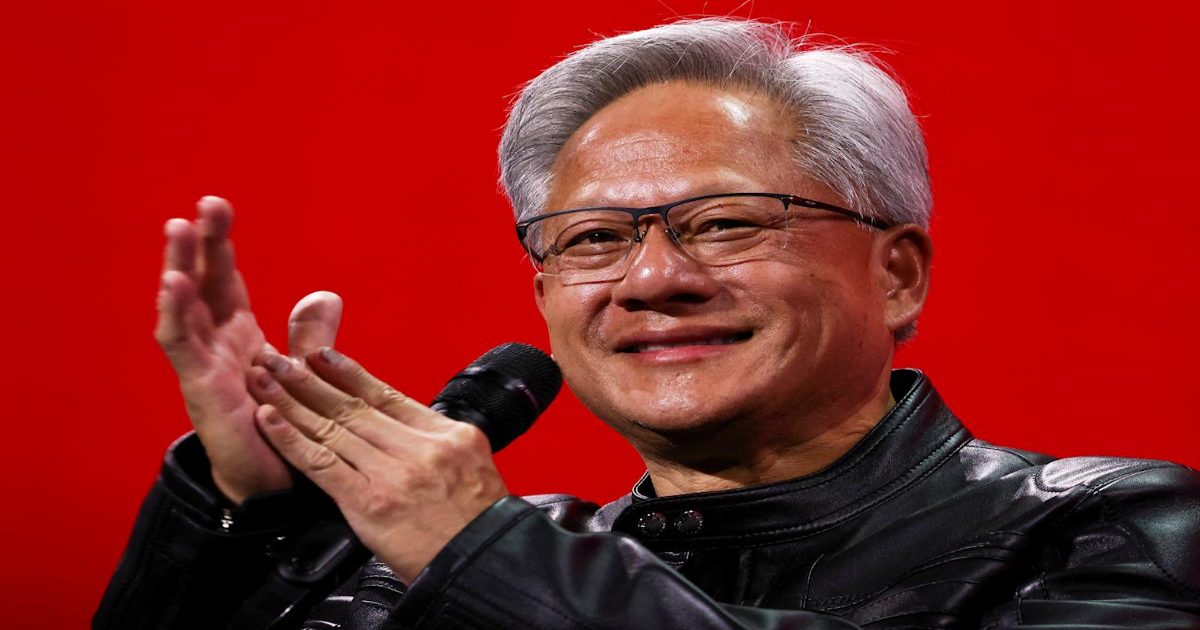

Nvidia president and CEO Jensen Huang delivers a speech during the Computex 2025 exhibition in Taipei, Taiwan, on May 19. (AP Photo/Chiang Ying-ying) · ASSOCIATED PRESS

Nvidia has also benefited from the growth of so-called sovereign AI, or AI data centers that allow countries to use their own AI services rather than rely on those abroad. The company is expected to supply hundreds of thousands of chips to countries including Saudi Arabia and those across Europe.

Additionally, Nvidia has managed to shake off the Biden and Trump administrations’ bans on the sales of its chips to China. While the company took a massive $4.5 billion hit to its bottom line in its most recent quarter due to the ban and anticipates a larger $8 billion writedown in the current period, its stock price continues to climb.