Stocks rose Monday, with major U.S. indexes climbing 1% or more and everything from utilities to meme stocks rallying.

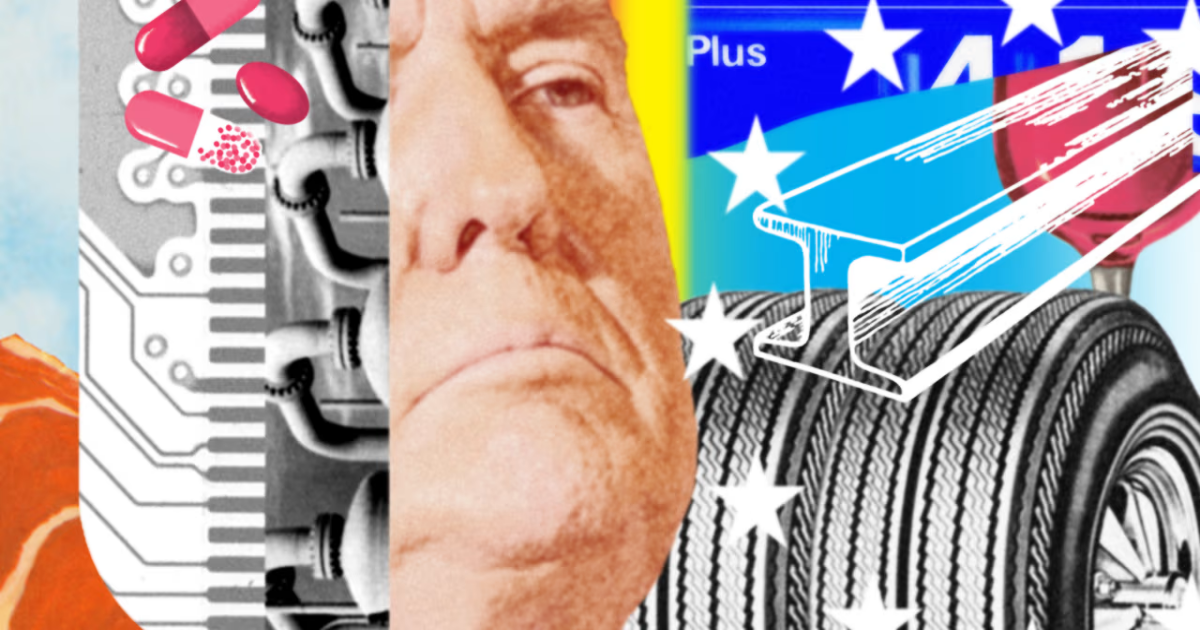

Markets were buffeted late last week by President Trump’s tariff moves, a gloomy jobs report and Trump’s firing of the head of the Bureau of Labor Statistics. Investors ramped up bets the Federal Reserve will cut interest rates in September.

The speed of the market U-turn surprised some investors. “I guess I thought we’d get a little bit more of a dip before they came in,” said Thomas Martin, senior portfolio manager at Globalt Investments. “People are hesitant to wait too long.”

Trump said late Sunday he will name this week successors for BLS Commissioner Erika McEntarfer and departing Fed governor Adriana Kugler. The surprise resignation of Biden appointee Kugler opens up a seat that Trump could fill with his intended successor to Fed Chair Jerome Powell.

The new trade deadline looms on Thursday. The stage is set for last-minute negotiations between the White House and countries still hoping to negotiate lower duties.

Companies reporting earnings include Palantir on Monday and McDonald’s, Disney and Uber later this week. About two-thirds of S&P 500 companies had reported quarterly results as of Friday. Of them, over 80% reported better-than-expected earnings per share, according to FactSet.

Stocks advanced. The Nasdaq Composite notched a nearly 2% gain, while the S&P 500 and Dow Jones Industrial Average each climbed more than 1%. Last week, the Dow industrials had their worst week since April.

Shares of American Eagle Outfitters jumped more than 20% after President Trump praised the retailer’s recent ad campaign.

Benchmark Treasury yields edged lower, to about 4.20%.

The dollar strengthened against the Swiss franc.

Oil futures fell in volatile trading. On Sunday, eight OPEC+ countries agreed to an output increase from September that was broadly in line with expectations.