This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

- The Chart of the Day

- What we’re watching

- What we’re reading

- Economic data releases and earnings

Why stop at $4 trillion? Nvidia (NVDA) bulls are looking to the next milestone: a market cap of $5 trillion.

It’s not particularly farfetched to imagine Nvidia becoming the first publicly traded company to grab both of those records. It was just over two years ago that Nvidia joined the $1 trillion club, riding the excitement over the breakout success of ChatGPT and reaping the rewards of building out an AI-focused data center business before AI became an earnings call buzzword.

The stock is up 21% this year, the best performer in the Magnificent Seven behind only Meta (META), which has been busy building an ultra-niche Avengers team of highly-paid AI experts.

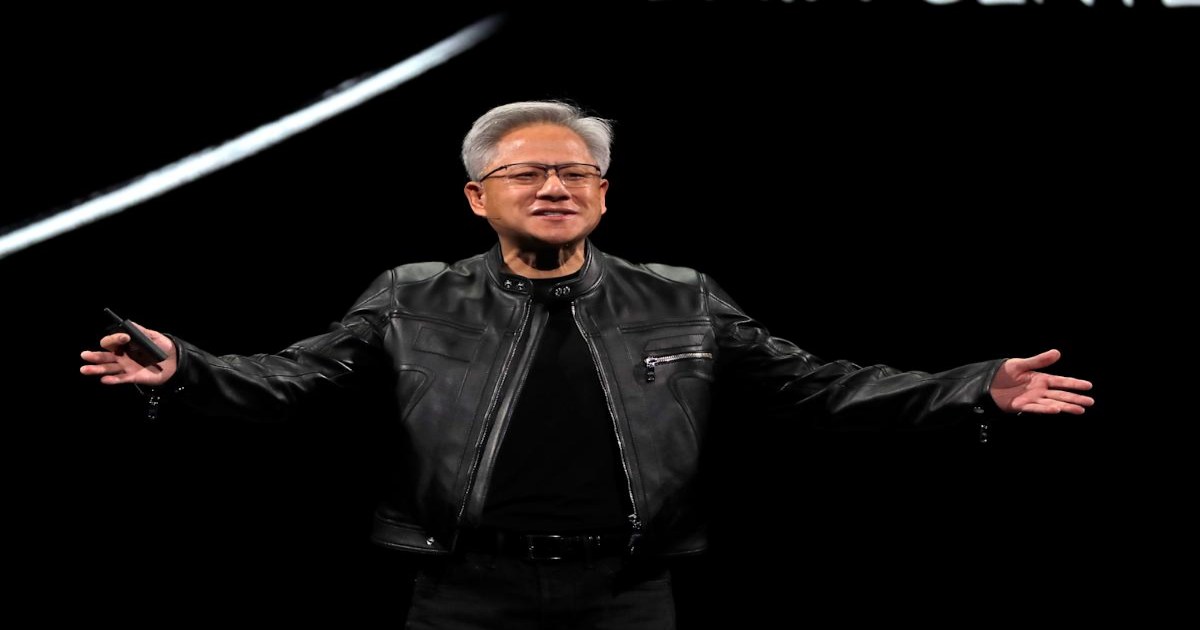

“There is one company in the world that is the foundation for the AI Revolution and that is Nvidia with the Godfather of AI Jensen having the best perch and vantage point to discuss overall enterprise AI demand and the appetite for Nvidia’s AI chips looking forward,” wrote Wedbush analyst Dan Ives in a note on Wednesday.

Nvidia’s chips are at the forefront of the generative AI boom. The company has shed earlier concerns of being less well suited for use in AI models after they are trained and has benefited from countries vying to keep their AI data centers within their borders. Nvidia has also managed to shake off regulatory concerns at home.

It pays to have a superior product. But Nvidia’s empire was also built by having the best customers.

As my colleague Dan Howley has reported, the biggest players in tech, each in command of vast fortunes and attempting to execute on grand ambitions, are spending hundreds of billions of dollars on the company’s hardware.

Tech behemoths, including Amazon (AMZN), Google (GOOG), Meta, Microsoft (MSFT), and Tesla (TSLA), rely on Nvidia’s products to build out their data centers. The cloud-based AI offerings and internal AI models at the heart of the latest tech transformation have generated an industrywide line item paid out to Nvidia.

The symbiotic relationship also favors Nvidia because the major tech platforms sit downstream of its chip supply. It’s true that every player in the AI ecosystem is taking on huge risks. DeepSeek unleashing a brief investor panic was a painful reminder of that.

But where the tech platforms have to eventually deliver on new, AI-centered services, fulfill promises and hype around building novel consumer habits, and usher in a new age of automated agents, all Nvidia has to do is keep selling chips.